DIAGNOSTIC REPORT - Sample

Project Title: Finance Transformation Project for a Startup Network Software Service Provider

Prepared by: Oreabetse Matlhare, Co-founder and CEO, The Scalable CFO

Proposal submission Date: November 8th 2020

Proposed engagement start date: November 15th 2020

Privileged and Confidential

Overview

The Company is a startup global networking company offering enterprises and service providers connectivity to internet, cloud and data centre infrastructure in 180+ countries. The company's product portfolio offers software-defined networking over our private network connecting 120+ POP’s (Point of Presence) in 56 cities, SDWAN reach to over 180+ countries, cloud connectivity and managed security services. The Company has a holding company in the BVI which is a 100% owner of the subsidiaries in Saudi Arabia, Dubai and London.

Founded in 2019 and backed by a strong team of 7 telecom / network software industry professionals, the founder and CEO of The company has over 20 years leadership experience in the global telecom markets.

The Company provides three primary services / solutions to its customers:

- Software Defined Networking (SDN)

- SDWAN

- Managed Security Solutions

Growth Strategy: The Company has developed its operations in the UAE within a short 7 month timeframe and has secured a solid client base spanning across the GCC (UAE, KSA and Qatar) and is experiencing hyper-growth. Currently bootstrapped, the management plans to capitalize on this hyper-growth and to secure additional investments to accelerate the growth of its sales, engineering, product marketing, customer care functions. The team has a commercial plan for the years 2021 - 2023; based on this plan, they need $1 million in growth capital. The team has offers on hand from a local company and is considering an investment range of $2 to $3 million for a 20% stake. The management believes that the average valuation for this type of company would be 8.9x EBIT. Given the trajectory of the business, including the solid reputation the team has within the industry and the wider business community, it has identified a number of opportunities to expand its product offerings to new market territory and to secure investments.

- Business Operations: The Company launched its operations in Q1 2020. It derives revenue from securing annual contracts (36 months) with its enterprise clients and charging recurring service fees, including a one-time installation fee. Currently the company is currently on a $145,000 (from 4 customers) recurring revenue, expecting to close the 2020 year at $245,000 total revenue and targeting $3 million by 2021. Noting that the gestation period for realizing funds can range from 6 moths to 12 months. The company is incurring infrastructure and network operation center costs including staffing, while there are some third party costs, such as regulatory fees, rent and utilities. The founder and managing team are currently not taking wages.

- Resources: The company is supported by a Finance Controller who is responsible for bookkeeping, accounting and generating reports.

- Infrastructure: Sales are managed using internal project management / CRM system. No accounting system is in place.

- Control environment: As the company is in early launch stage, currently minimal structured policies and procedures in place. Refer to diagnostic report in the appendix.

Personality Assessment

The Founder & CEO

Candid, Persistent, Meticulous

Results & Success Path

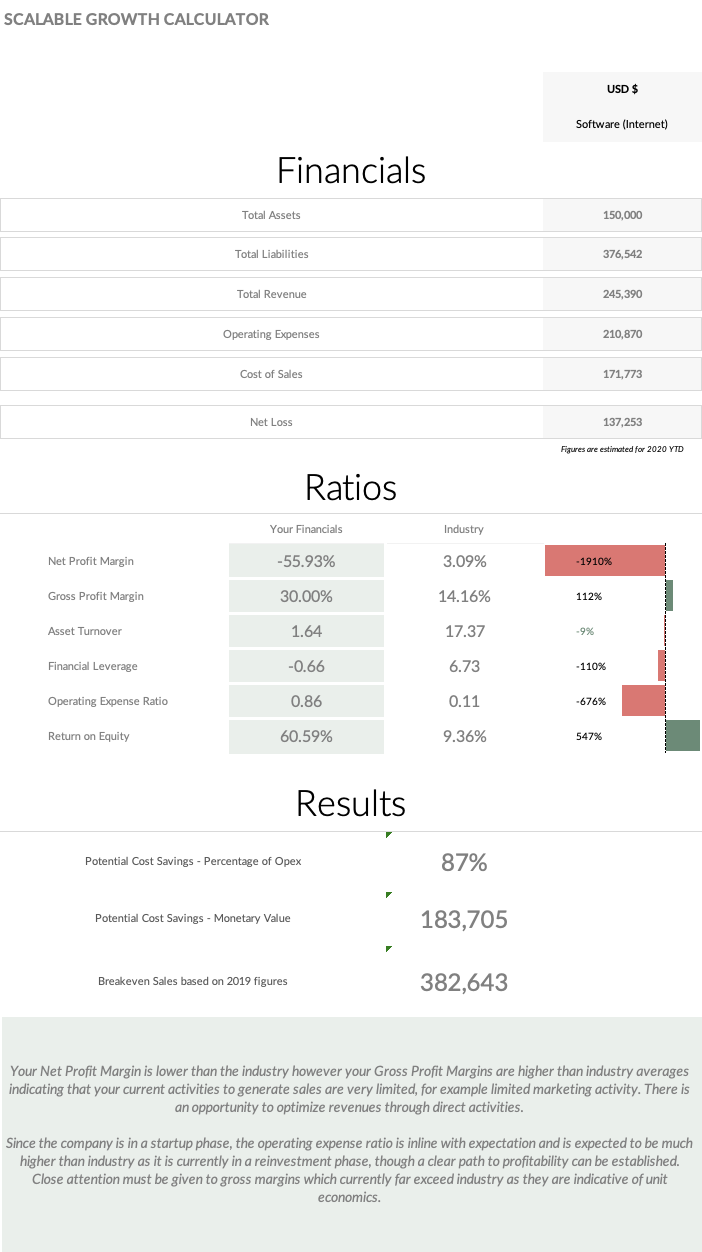

Health Score & Ratios

43%

Growth File Score* - indicates opportunities to improve control environment (see details in the appendix).

87%

Potential Cost Savings* - indicates that cost are currently not optimized (see details in the appendix).

Challenge

The founder is currently exposed to cash flow risk as the management funds are tied up due to the long setup period. The management team are in a risky position as they are considering various financing options without the having the right finance tools and models in place. He also does not have the bandwidth to dedicate enough time to manage the finances of the business along with the strategic operations. This puts the company at risk of not securing the required financing, not achieving the commercial plans and not optimizing value from their own investment.

Key Addressable Issues

The founder appears to have clear strategic intentions for managing the business. In addition, it is evident that the team has found a way to manage the company's finances since the company's inception, however the lack of finance team strength (manpower, skills, knowledge), the absence of clear processes and the inadequate financial planning, controlling and reporting activities serve as a significant barrier in better informing strategic decisions to identify and seize opportunities for driving growth, profitability and process efficiencies.

Key issues to be addressed:

- 1.Resource limitations - The company has growth score of 43% that indicates that there is some work to be done in maintaining an appropriate control environment. However there is a clear skills limitation that will not support growth plans and thus the founder needs a CFO to step in and support the management with professionalizing the company's Finance Operations, build the Finance team capabilities in-house over time.

- 2.Inadequate strategic planning - The company needs a strategic financial budget, cashflow forecast and a valuation that can fully support operational activities, facilitate strategic and investor discussions, including identifying and quantifying better ways to price its services, drive revenues & profitability and control expenses. The team requires a strategic plan to adequately reflect a sustainable business model. The immediate need is to review the models and financials that are already in place and to assess whether figures are reasonable to present to investors

- 3.Inadequate reporting - The company needs a transaction cleanup, monthly financial reporting implementation and a technology system review. The company needs the implementation of a monthly financial reporting deck for the management and investors to support strategic decision making. The team needs to better track key metrics so that management is confident about company performance and its Financial Reports. As the company plans to expand into new markets and prepare for fundraising; it is becoming increasingly critical for the management to know its Working Capital Debt and balance sheet position at any given point in time. There is an immediate need to address obligations such as VAT.

Success Path

These are the stepping stones that are currently barriers that a company typically needs to overcome to address the issues and achieve desired results. In the next phase, Your CFO will help you by developing a roadmap with actions and priority timelines.

- Transactions - We need a clear and accurate picture of the finances of your business. This means potentially 'cleaning up' or 'catching up' transactions to represent the true nature of activities according to best practice accounting principals and regulations.

- Strategy - We need to develop the right planning and reporting discipline to support strategic decision making and due diligence.

- Tech - We need to ensure the right system setup is in place and functioning as needed.

- Processes - We need your transactions to remain accurate, efficient and that we reduce chances of financial losses by establishing processes and controls to align with company-wide operations.

- People - We need to build your team to have the right skills and right understanding of processes to ensure high performance.

Appendix - Diagnostic Results

About The Diagnostic

- 1.The purpose of the Growth File Score is to establish baseline health score of the non-financial control activities of the company based on International Financial Reporting and Auditing Standards. The scope of the Growth File diagnostic is limited to Accounting and Reporting Growth Areas. Growth Areas that are out of scope of this diagnostic but may be included upon request are Strategy, Corporate Governance, Risk & Compliance, Human Resources and Technology Systems. A low score indicates a potential weakness in the discipline and controlling of Financial Activities of the company and therefore potential exposure to risk of:

- Financial loss

- Material misstatement in the accounts due to fraud or error

- Unsuccessful and costly audits

- 3.The purpose of the Growth Calculator is to establish financial health ratios based on a tried technique that breaks down the drivers of Return on investment to establish the company's financial health using a company's own key financial data and determine a benchmark using reliable and tailored data sources specific to the region and industry. For purposes of this diagnostic, we will run the Calculations after assigning the consultant.

Overall Growth File Health Score

Your Score 43%

Detailed Growth File Health Score